The answer is YES.

The pandemic has changed many things. While some things are returning to normal, the workplace is now so different and forever will be.

Where is the workplace market heading next? This question is important to everyone in the workplace profession, and so far, our efforts to find answers have been limited to traditional means. Conferences, workshops, podcasts, just to name a few. While early findings have reported many new ideas, we still don’t see clear patterns that can help strategize the plans of each individual design firm. With the world’s news filled with so many uncertainties, we need to come to grasp of what ideas fit with which realities. Soon.

With this in mind, we’ve decided to create a Work Design Designer Sentiment Index (WorkDesign DSITM) project to try a new approach. That is, instead of basing on what’s explicitly said or heard in the field, let’s dig into the Collective Intelligence of architect and design firms. This endeavor is based on our decade-long success of using psychology-enabled smart surveys to understand what’s top of mind for everyone.

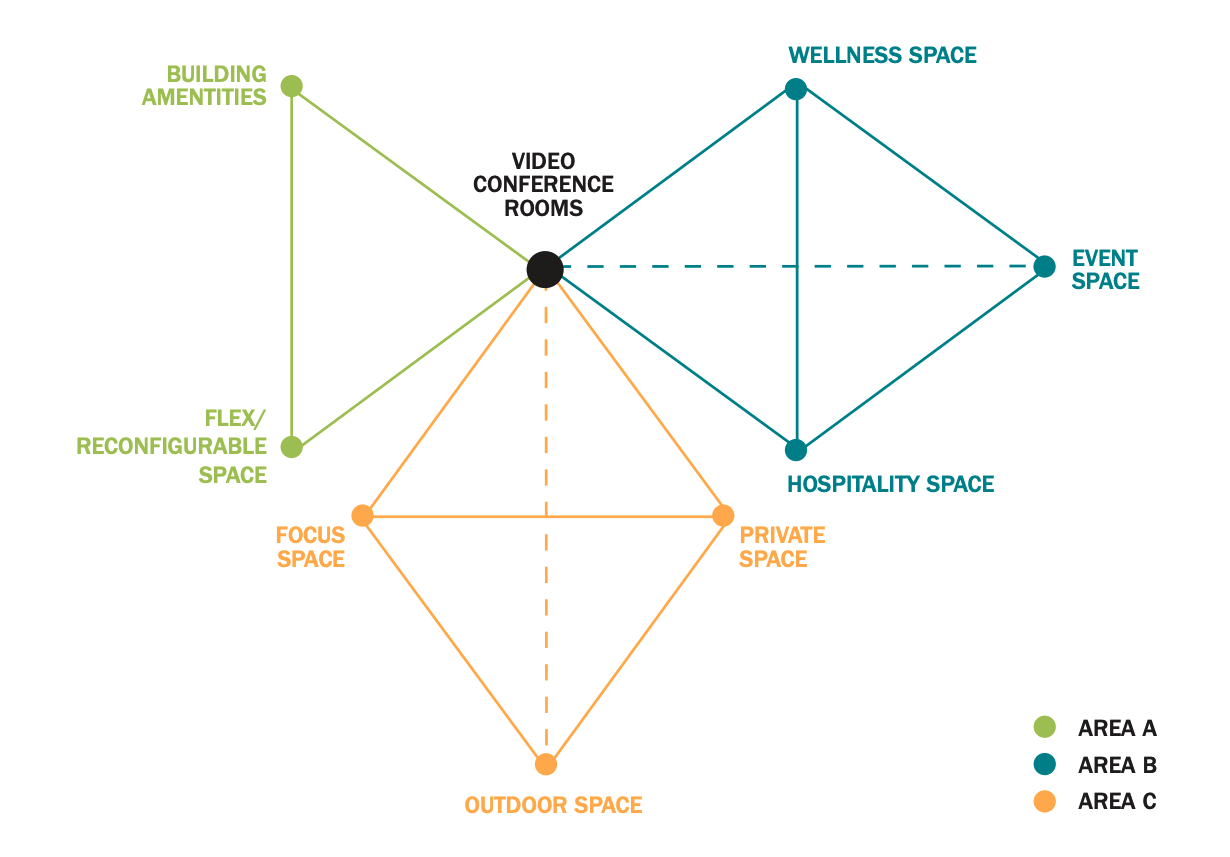

In Q3, we approached readers of Work Design from three test areas (Test Area A, B, and C) to participate in our beta test. Test Area A covers the Northeast region of US. Test Area B represents responses from Midwest and Southeast. Finally, Test Area C shows responses from the West regions of US. The resulting data is showing powerful patterns that can answer important questions about the workplace market. Before kicking off the 2022-Q4 edition of the DSI project, we’d like to share some of the outcomes from our beta test.

The basis of the DSI project is simply – what we each individually see and feel can become exponentially more valuable when pooled together into a Collective Intelligence. If you’d like to know more about how we did it, that information is at the end. But on to the sample top findings first! (All example patterns below reflect 2022Q3 only).

#1: Some parts of the Workplace industry have recovered better than others. What are the underlying causes?

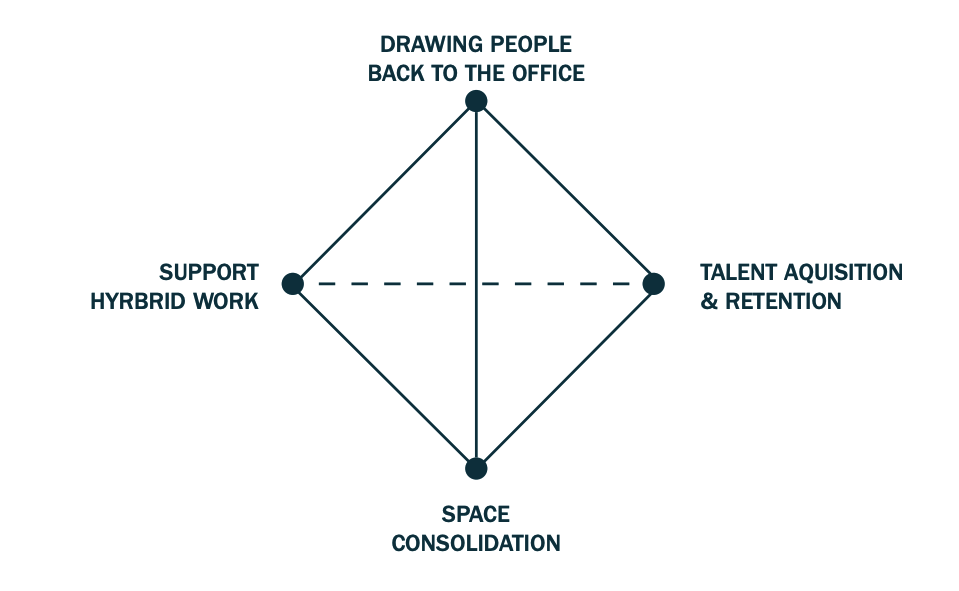

With so many buzz words flying around, it is hard to tell what truly matters to each design firm’s growth. Based on the beta test, the best-case scenario for a design firm is driven by the following cluster of client needs: “Drawing People Back to Office”, “Supporting Hybrid Work”, “Space Consolidation”, and “Talent Acquisition/Retention”. Firms who have this type of clientele have recovered the best from the pandemic and are the most bullish about the future. Client bases for which the recovery is less robust are ones where designers’ collective attention does not include addressing Talent challenges! This pattern is universal across all three Test Areas.

#2: Economic situations drive the workplace (and localized culture too).

Based on what our beta participants collectively observed, the workplace market in Test Area B has recovered much more robustly than Test Area A. Interestingly, the workplace growth drivers in Area B may indeed be the weaknesses that have existed since before the pandemic. Specifically, wellness, hospitality and event spaces drove Area B’s new workplace business in 2022Q3. Given that these are popular and proven designs, “Acceptance of New Design Concepts” is not a top concern of designers in Area B, even though it is a top-of-mind issue among designers in other test areas.

#3 The post pandemic workplace must create a draw! *

* However, the kinds of the draw need to be precise.

In general, utilization and workforce experience have long been the center of attention from the client’s perspective. Many workplace metrics revolved around them. Based on the collective “gut feel” of the designers in our beta test, it is interesting to see clear patterns where companies really need a “Wow me back to work” kind of workspace. Specifically, Test Area A prefers to add “Video Conference Rooms”, “Building Amenities” and “Reconfiguration/Flex Space” to their workplace, Area B prefers adding more “Wellness Space”, “Event Space”, “Hospitality Space” and “Video Conference Rooms”, and Area C wants to add “Focus Space”, “Private Office”, and “Outdoor Space” to their workplace.

In terms of the DSI indices, the three test areas are benchmarked as the following. The indices are in the same range as typical consumer sentiment indices. Each value is in the range of 0-100, with 50 being neutral, 100 being the most positive, 0 being the opposite.

| DSI: Past Growth | DSI: Current Confidence | DSI: Growth Expectation | |

| All US | 67 | 76 | 70 |

| Area A: Northeast | 66 | 69 | 66 |

| Area B: Midwest + Southeast | 74 | 61 | 84 |

| Area C: West | 54 | 84 | 58 |

DSI Past Growth is the trailing indicator, which shows that Area B has undergone the most robust recovery growth.

DSI Current Confidence shows how designers and architects perceive the present-day business condition, indicating that Test Area C, even though recovered the least among the three test areas, started with a high level of Workplace activity before the pandemic and still has more than other areas.

DSI Growth Expectation is the advance indicator showing how designers feel the market growth will continue to drive their own business growth. For example, Area B, while having grown the most, expects to continue a hot growth trajectory.

Ready to Participate in the Next One?

We hope you found this helpful and if you represent an Architecture or Interiors firm that would like to participate in the future, email Michelle Weiss to be added or simply sign up for our Monday Newsletter below to be considered. Stay tuned for future invites and insights!

Methodology

About the smart survey instrument used for the WorkDesign DSI Project: Smart survey is an invention introduced to the market in 2013 by researchers at the University of Tennessee, Knoxville. By combining AI, art and psychology, the methodology of smart survey is the only scalable method to robustly observe people’s shared attention to gain understanding of their shared priorities. The technology has been used by Work Design for a number of projects, including for the past three cycles of The Next Work Environment Competition (TNWEC), future editorial topics, and more. The same technology has been used for successful workplace projects at LinkedIn, Adobe, Uber, Google and many other companies. Click here for more in depth information about the origin and all-around use cases of psychology-enabled smart survey.